What is Your Circle of Competence?

Value investors want to invest in companies that are within our “circle of competence” - a zone or area of expertise, where we have a lot of knowledge. And how do we find out what is in our circle of competence or circle of knowledge? Typically, you have expertise within the area of your work and profession. You’ll know certain thing about the industry you’re in, that you can use to your advantage. A teacher might know certain educational programs that works really well or use a certain kind of computer or other equipment, that’s great to use for educational purposes. Note down the brand names for your “wonderful” inspiration list.

To find out what is in your circle of competence is ask these questions and note the answers down:

- What do you work with/ how do you make money?

- On what and where do you spend money?

- What do you like to do when you’re off work?

- And what are some of your values that a company in the world needs to be aligned with in order for you to want to invest?

By now you have a lot of areas that are within your circle and now you need to brainstorm on products, services and companies that are within these areas. If there are industries or sectors that are mentioned multiple times – bonus point – try to find products and brands within this sector first.

Last but not least: is there a product you really love using? Or a service, restaurant, experience? Think about something you absolutely enjoy using, eating or going to, that you rave about to your family and friends or coworkers and find out if the company behind the brand is publicly traded.

How do I find out if a company is listed on the stock exchange?

The easiest way to find out if you can buy shares in the product or brand, you love is to first find out which company produces this product. Once you’ve found the company name you can search on Yahoo Finance to see if it’s a public or a private company. If it’s a private company, you won’t be able to buy shares of stock. If it’s a publicly traded company, the owners of the company are the shareholders and you’ll be able to be an owner of the company by buying the company’s stocks.

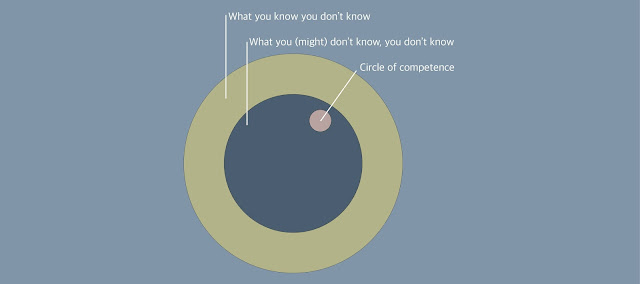

Stay within your circle of knowledge

Warren Buffett and his business partner Charlie Munger often mention that they stay within this circle and actually don’t even go near the edge. They’ve found certain patterns in businesses, and when they see these patterns, they know to react when the opportunity comes.

"You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital."

Warren Buffett

As Buffett mentions in the quote above you want to make sure to reflect on where your boundaries are – though you might spend your money on insurance, do you really know what the insurance business is about? Insurance business are extremely complex, and though Warren Buffett has been successful with Geico, others have not been able to understand the complexity. Ex. super investor Monish Pabrai had to exit his investments in insurance. Also Bank products are incredibly complex and the banking industry might be too difficult for you to understand. Even Lehman Brothers got so complex that it collapsed.

Be sure to really narrow down what your circle of competence is.

I recommend reading these articles too:

Get started with value investing now

Comments

Post a Comment