How Can You Tell If a Company Is Profitable?

Some people will spend a lot of time doing research before they buy a new dishwasher or choose which model car they want to buy, but then when it comes to buying stocks, they don’t do any due diligence but buy what they heard about in a podcast or picked up in a social media post. It’s important to change your perception of what a stock is.

A stock is linked to a physical business with offices and machines etc. Let’s say you had a dream about owning a small cozy cafe, and a café just like that was put for sale in a neighborhood nearby. Wouldn’t you want to investigate the business before you acquired it? What if it had a lot of debt or what if the business came out with a loss every year - you would want to know that. It’s the exact same thing with a stock.

Though you can put less money into the company than if you had to purchase a café, and with a stock you can choose to only own one share of the whole business, you want to make sure it’s a healthy one.

How to tell if a company is losing money

The first thing you can do is to open the company’s annual report. The annual report for a company on the stock market is publicly available and you can find it on the company’s website on the “investor relations” page. It can be overwhelming the first time you open this report, but this will be easy because what I want you to focus on right now is to scroll down to section 8 (for American companies) to the financial statement. In this section find the Income Statement. This is sometimes referred to as a profit-and-loss (P&L) statement or an earnings statement. Once you’ve found the Income Statement you must scroll a bit more to the bottom of the statement and find the Net Income (sometimes called Net Income from Continued Operations).

To determine if the company had a profit or loss for the year look at the number – if the number is in brackets () the company had a loss. It is losing money. A bracket is the same as a minus and the reason brackets are used is because it’s much easier to spot a bracket rather than a -. See how tiny that sign is – it’s easy to overlook.

If a company has a net loss, then it means that they have more expenses than what they sold. Or to use the financial terms: that the company’s total expenses exceeded the revenue produced for that year.

If the number is not in a bracket the company was profitable that year.

Now you have your first clue to what kind of business this is – are you still thinking about buying their stocks? As an investor you wouldn’t want to buy a company with a loss. If you are a speculator or day trader, the profitability might not be relevant at all but for an investor the health of our investment is important.

The next step is to look back and check the number 10 years back. It doesn’t take long because you just need to open the annual reports and scroll down – now you know where to find it. We want to see a stable profit 10 years back. If it’s not stable, we don’t have to buy the stock. We can find another company and we know what to check for now.

Profitable Margins

Last step you should do to evaluate the profitability of a business is to calculate the Profit Margin also called Net Margin.

The profit margin is the ratio of profit remaining from sales after all expenses have been paid. Rent, marketing, labor, waste removal, NetJets private jet rental to CEO – you name it. You want lots of profit left after expenses have been paid and a company that is very mindful about expenses - so not too many luxury trips on a private airplane. Let’s calculate how much money is left of the sales after the company has paid their expenses.

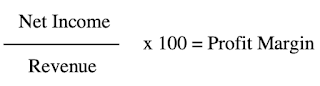

You already have the first number for the calculation: the Net Income. Open your calculator app and put in the number from the Net Income row. Then scroll back up in the Income Statement to the very first line: “Revenue”. In your calculator app you click the division sign ÷ and type in the Revenue and last multiply with 100.

Formula: Net Income/ Revenue x 100 = Profit Margin

I often get this question: how high should the profit margin be? There’s no right number. How high depends on industry, so you can’t compare profit margin across industries. But you absolutely can and you should compare the profit margin of your business to their competitors. You want your wonderful business to have the highest profit margin because if they can keep their expenses down, so there is cash on the bottom line, then the company is profitable and we want to buy profitable businesses.

Related Articles:

What Are My First Steps? (The Easy Way To Get Started)

How Can You Tell If a Company Is Well Managed?

How Do You Know If You Can Trust The Management?

Comments

Post a Comment