How do You Unleash Your Investing "AHA!"?

Do you know of those moments in life where you get this big AHA!-moment and something you thought was a set way, or worked a certain way turned out to have a completely different angle to it than you thought to begin with? This article might change your world view in a profound way and you might change how you invest.

Investing and being successful at it is not about picking a stock because you believe that the stock price goes up.

Many individual investors believe that investing is about predicting a future trend and buying a stock that will likely go up. Making a bet on a stock. I used to believe the same and it turns out that Warren Buffett early in his career as a stock investor also invested with this mindset: picking stocks that he believed would go up.

What made everything change – the time where the lightbulb went on for Buffett - was a book he picked up. The Intelligent Investor by Benjamin Graham.

“I saw this one paragraph and it told me; I had been doing everything wrong. I had the whole approach wrong – I thought I was in the business of picking stock that would go up and one paragraph made me see it was totally foolish”, he said at the 2022 Berkshire Hathaway meeting I attended in Omaha.

|

| Photo taken by me at the annual meeting |

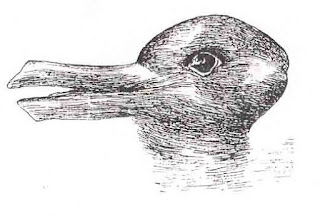

He had an aha-moment – a point where suddenly, he saw something he hadn’t seen. Like an “ambiguous illusion” that shifted one objective to the other as his perception of them changed. He had an illusion that he was supposed to pick stocks that would go up until he read one paragraph in chapter 8 of The Intelligent Investor.

|

| Warren Buffett showed us a similar “ambiguous illusion” at the 2022 Annual Meeting |

“I don’t know how long I would’ve gone on looking for “head and shoulder” formations* and 200-day moving averages* and the odd lot ratios and a zillion things and I loved that kinda stuff… except it was the wrong stuff I was looking at!”

Buffett did not mention which paragraph changed his world view, but it could be this paragraph from chapter 8 in Benjamin Graham's The Intelligent Investor:

”The most realistic distinction between the investor and the speculator is found in their attitude toward stock market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices.”

Are you trying to predict which stocks will go up? It’s time to change your mindset and focus on the business instead of the stock. Is it not just a ticker symbol on a screen and some charts going up and down – you’re investing in a business and you want to make sure it’s a high quality one you’re buying.

*The terms "Head and shoulder formations" and the "200-day Moving Average Indicator" are used in technical analysis - a discipline within stock trading where a trader looks for patterns in the stock chart. Buffett was a technical analysts in his early years and looked for patterns in the stock's price movements. He stopped that type of trading when he read Graham's book.

The article contains affiliate links to Ben Graham's book. If you buy the book using the link, I will get a commission.

Comments

Post a Comment