How to Transform Your Spending Patterns.

To change your financial future, and one day be financially independent, you must make some decisions with money, and one great step you can take is to change spending patterns. To keep your expenses low, control what you spend your money on and invest your money, so that one day you can live a life of financial independence. In this article you can read tips on how you can change from spending to being conscious and intentional with your money.

Every month you should review what you’ve spent your money on. You can do that by either logging in to your online bank and going through each expense you’ve had or you can use an app that tracks your expenses. In the beginning of my transformation journey I would check every expense in my account – now I use an app.

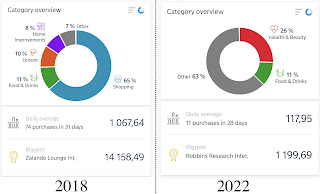

Here’s what you can do: at the beginning of a new month save your latest monthly statement in an excel spreadsheet and color code every expense manually. Create a color for each category. This is one way to see which categories you're spending most on. A category could be clothing, travel, caffe latte, restaurant visits, sport etc. Back when I did it this way, my expenses were primarily on clothing and accessories and dining out (including lots of latte’s). I wanted to change my spending patterns, so it was embarrassing to see how much money I spent on material stuff, and it wasn’t easy to change the pattern – it really wasn’t because I would still get carried away and buy stuff in a spur of a moment. But over time it didn’t feel good because every month I was looking through the color codes. It felt much better as I saw the colors change and that helped so that every time, I felt tempted in the moment, I tried to be mindful and thought about how much better it felt looking at the statements when I hadn’t spent money on clothes etc. At some point it just flipped, and I rarely have expenses for clothing, bags, and shoes now (I have a closet full of stuff and pack my summer clothes and shoes away, so I have a “new” wardrobe twice a year – maybe an idea for you if you’re a big spender).

Today there are apps that can show you your monthly spending patterns. These apps vary from country to country, but Spiir app is one, Nordea Wallet, PocketGuard and others. To get that visual overview can help you not overspend and even gamifies changing to "healthier habits".

My recommendation is to change your spending pattern, so you have more money freed for investing and for education. Today 20 percent of my monthly income (after tax – the income that ends up in my bank account) is used for investing purposes. I immediately transfer the money into my brokerage account. I don’t purchase shares every month, but I use it for options trading or to save so I can buy a large number of stocks when they’re on sale.

"When it's raining gold, reach for a bucket, not a thimble."

Warren Buffett

10% of my monthly income is for charity – I sponsor a child through SOS Children's Villages, and I also support refuge for abused women and their children, plus what comes up in the world – right now supporting children in need from the war in Ukraine.

The rest of my monthly income is used for mortgage, utilities, and food – monthly necessities, for savings and now my main splurge is on education (coaching, courses/programs, and books etc.) plus going out to a restaurant or getting a wellness/beauty treatment now and then.

Comments

Post a Comment