Why is investing better than saving?

Are you saving up to live a good, secure life later? I used to be such a “good girl” saving my money in a savings account for times of trouble. But is saving the right way to grow your money? The answer is a clear no.

At the time of the publishing of this article interest rates are low, which means that most savings accounts give 0% in interest. And in some parts of the world, like Denmark, you have to pay interest to leave money in your savings account.

And then there’s inflation - a phenomenon controlled by governments around the world. Inflation will eat those savings one small bite at a time. The global inflation rate is currently 3%.

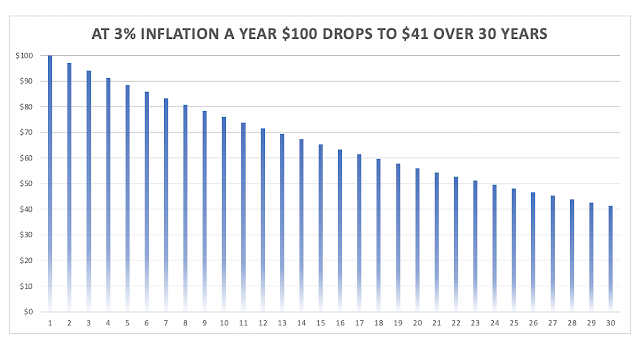

Take a good look at this graph because it’s pretty scary information: In 30 years $100 will leave you with $40 in spending power. $40!! 💸 And now this message is more important than ever. Have you heard inflation is increasing?

What the graph means is that you’ll have to get an interest rate that’s higher than avg. 3% per year to not end up with less money than you have today.

Every year your money loses buying power. Without you doing anything wrong your savings will become less worth over the years so the $10 that would buy you a huge ice cream today, will buy you a significant smaller ice cream in 20 years if you left the $10 in your savings account. You must find a way to let your money grow more that 3% per year on average in order to just come out with the same buying power as today. If you want more money in the future the annual growth rate must be more than 3%.

The S&P 500, which is an index of the biggest American companies (measured on market capitalisation), has grown 7% per year on average since 1957 (adjusted for inflation). Had you bought a low-cost, accumulative EFT shadowing the S&P500 Index your money would've grown over the years – and left you better off than saving money in the bank.

This means that intelligent and cautious investing is better than saving.

Disclaimer: I want to guide and help you by providing great content, direction, and strategies. All my products and services are for educational and informational purposes only. As stipulated by law, I can not and do not make any guarantees about your ability to get results or earn any money with my ideas, information, tools or strategies. I don't know your financial situation and cannot and will not provide financial advice. Nothing on any of my websites, or any content or curriculum is a promise or guarantee of results or future earnings, and I do not offer any financial, legal, tax or other professional advice.

Comments

Post a Comment