Why Is The Stock Market Down Today?

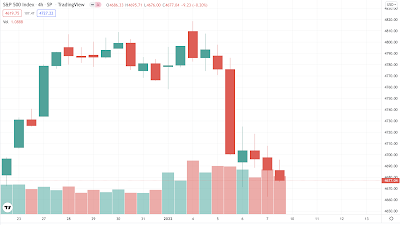

This week the S&P500 posted a loss of 2% - which in a long-term perspective is really nothing at all. It’s a tiny correction. But what I see on social media is panic and questions like:

- Does this mean that it’s a good time to invest?

- Some experts foresee a crash in the stock market due to inflation, what’s your advice?

- I’m down 27% and as a beginner this is not motivating. What should I do?

- Why did some investors get triggered by this news and consequently trigger a drop in the stock market?

First of all, the market is in red because earlier this week the American Federal Reserve (also known as the Fed) released their meeting minutes suggesting an increase in interest rates at an earlier time than they’ve previously communicated.

It's a domino effect happening: the Fed raise interest rates, a company's cost of capital goes up, this increases the discount rate in the stock analyst models, which then decreases the valuation of the company's stock price. The analysis's sell to reflect the price in the new valuations, and the stock prices fall.

Further, an increase in interest rates impacts the stock market because of something called “risk free rate” that's something the big investment firms look at, and Investopedia have a fantastic and simple description:

The risk-free rate of return is the theoretical rate of return of an investment with zero risk. The risk-free rate represents the interest an investor would expect from an absolutely risk-free investment over a specified period of time.

How much of a correction we will see is impossible to predict and we shouldn’t really focus on that, but just accept that it might be coming. It’s a part of a natural cycle and if the Fed increase the interest rate 1%, we could potentially see a drop of 20% in the S&P to balance out the risk-free rate.

New Possibilities in the Future

With the low interest rates in the past the Fed has forced investors to buy stocks because there was no alternative. Investing in bonds have been a poor investment because of the low interest rate paid to investors. Once the fed increase interest rates an alternative investment to stocks could be ex. treasury bonds because there will be a higher return on a paper that’s considered risk-free.

Ulrik Bie, Economic Editor at the Danish Newspaper Berlingske shared this experience from his past as an executive at an investment bank:

"When the economists made their future prognosis showing a slowdown in the economy and recommended low-risk trading, the analysts always asked: “will the central bank increase the interest rate?” If the economists answer was no, then the analysts knew the stocks would continue to go up. “What else is there to do?”, they asked."

A great example of the situation we've been in: limited wiggle room, and that might change for the better in the future with more possibilities to invest in other assets.

What Should You Do?

No one have a crystal ball and can predict what happens when – many "experts" will speculate about what will happen and when, but that’s all it is: speculation.

If you’ve already bought stocks, I can’t advice you what to do because I don’t know your unique situation and I’m not a Certified Financial Advisor. What I encourage you to do is to not panic but read this article that will help your work on your mental state: What Should You Do During a Market Crash?

If you haven’t invested yet or if you’re a new value investor that might be panicking a bit, it’s important for you is to stick to Warren Buffett’s investing strategy and focus on finding a wonderful business at an attractive price or revisit your business case and check that your business is still wonderful – it might soon be time to buy more.

The correction in the market could’ve put your wonderful business at a price that’s wonderful but because of stock being overvalued now, it’s likely that this correction did not mean that your business fell to a desirable price. However, when the increase of the interest rate takes place, it could be time for us value investors to go on a shopping spree.

What should you do? Well, for some of you it could be time to open that checklist and walk through a company using each of the steps in the list and be ready to buys when time comes.

For some of you it might be time to educate yourself about value investing, and learn how to valuate a business with a valuation model, so you can buy at a favourable price and if now is your time, I would be honoured to teach you.

Comments

Post a Comment